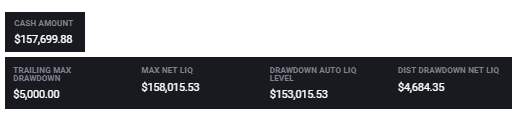

In order to calculate the max unrealized gains on your account, you need only the following values -

1. Account Value

2. Max Trailing Drawdown (under equity button)

3. Evaluations drawdown value (please see products page)

Account Value (157,699.88) - Max Trailing Drawdown (4,684.35) = Liquidation Threshold (153,015.53)

then

Liquidation Threshold (153,015.53) + Evals Trailing Draw down value (5000) = Max Unrealized Value (158,015.53)